International Market Pricing Strategies

Table of Contents

Pricing Strategies for Global Expansion [ International Market 3 ]

Introduction

Navigating the complexities of international markets requires adept strategies, particularly in pricing. Crafting an effective pricing strategy can spell the difference between success and failure in global expansion endeavors. In this exploration of International Market Pricing Strategies, we delve into the multifaceted landscape of pricing tactics tailored for global markets. From understanding diverse consumer behaviors to adapting to fluctuating economic conditions, join us as we uncover the key principles and real-world applications essential for thriving in the international marketplace.

Here’s an in-depth exploration of key pricing strategies, complemented by real-world examples from various industries:

1. Market-Based Pricing [ International Market Pricing Strategies ]

Market-based pricing involves setting prices based on the prevailing market conditions and competitor pricing in each target country. This approach requires a thorough understanding of local market dynamics, consumer preferences, and competitive landscapes to determine optimal pricing strategies. By aligning prices with market realities, companies can enhance their competitiveness and capture market share effectively.

A notable example of Market-Based Pricing is exemplified by Xiaomi, a prominent global electronics company renowned for its innovative smartphones. In highly competitive markets like India, where Xiaomi faces stiff rivalry from other smartphone brands, the company strategically adjusts its pricing to maintain competitiveness and attract consumers. By closely monitoring local market conditions and analyzing competitor pricing strategies, Xiaomi ensures that its smartphones are priced competitively to meet consumer demands while maximizing market penetration.

This agile pricing approach enables Xiaomi to navigate diverse market environments and sustain its position as a leading player in the global electronics industry.

2. Cost-Plus Pricing:Definition [ International Market Pricing Strategies ]

Cost-plus pricing is a method where the product price is calculated by adding a markup percentage to the production cost, ensuring a consistent profit margin. This straightforward approach provides companies with a clear formula for determining prices while safeguarding profitability.

Tesla Inc., a renowned electric vehicle and clean energy company, exemplifies the application of Cost-Plus Pricing in its international markets. By incorporating a predetermined markup to cover production costs, overhead expenses, and desired profit margins, Tesla maintains financial stability while remaining competitive in the automotive industry.

This pricing strategy allows Tesla to offer its vehicles at prices that align with market expectations while ensuring sustainable profitability across its global operations. Through Cost-Plus Pricing, Tesla strikes a balance between affordability and profitability, reinforcing its position as a leader in the electric vehicle market.

3. Skimming Pricing [ International Market Pricing Strategies ]

Skimming Pricing is a strategic approach whereby a product is initially introduced at a higher price to target the high-end segment of the market. Over time, prices are gradually adjusted downward to attract a broader customer base.

Apple Inc. is renowned for its adept utilization of Skimming Pricing, particularly with its flagship products like the iPhone and MacBook. Upon launching new products, Apple sets premium prices to cater to early adopters and tech enthusiasts willing to pay a premium for cutting-edge technology and exclusive features. As the product lifecycle progresses and competition increases, Apple strategically reduces prices to make its products more accessible to a wider audience.

This dynamic pricing strategy enables Apple to maximize profits during the product’s initial release, capitalize on the demand from early adopters, and subsequently penetrate broader market segments as prices become more competitive. Through Skimming Pricing, Apple effectively balances exclusivity with market accessibility, solidifying its position as a leader in the consumer electronics industry.

4. Penetration Pricing [ International Market Pricing Strategies ]

Penetration Pricing is a strategic approach where a product is initially offered at a lower price to quickly gain market share, particularly in fiercely competitive markets. This tactic aims to attract price-sensitive consumers and establish a strong foothold in the industry.

Netflix, a prominent streaming service provider, effectively employs Penetration Pricing to appeal to cost-conscious consumers worldwide. By offering subscription plans at lower rates compared to competitors, Netflix rapidly expands its user base and solidifies its position as a dominant force in the streaming industry.

This aggressive pricing strategy enables Netflix to capture a significant market share and maintain a competitive edge in the crowded streaming market. Through Penetration Pricing, Netflix effectively disrupts traditional media consumption patterns and establishes itself as a leader in the digital entertainment landscape.

5. Dynamic Pricing [ International Market Pricing Strategies ]

Dynamic Pricing is a strategic approach where prices are adjusted in real-time based on various factors such as demand, competition, and market conditions. This agile pricing strategy allows companies to optimize revenue and enhance customer satisfaction by aligning prices with current market dynamics.

A prime example of Dynamic Pricing is demonstrated by Grab, a prominent ride-hailing and delivery service provider. During peak demand periods, such as rush hours or inclement weather, Grab dynamically adjusts prices to optimize fares and incentivize more drivers to be available on the platform. By increasing prices during high-demand periods, Grab ensures the availability of drivers and maintains reliable service for customers.

This dynamic pricing strategy enables Grab to effectively manage supply and demand fluctuations, enhancing the overall user experience and maximizing revenue opportunities. Through Dynamic Pricing, Grab demonstrates its commitment to innovation and customer-centricity in the competitive transportation and delivery industry.

6. Bundle Pricing [ International Market Pricing Strategies ]

Bundle Pricing is a strategic pricing method where multiple products or services are offered together as a package at a discounted price. This approach aims to increase sales by enhancing the perceived value of the bundled products and encouraging customers to purchase the entire package rather than individual items.

An exemplary instance of Bundle Pricing is illustrated by Microsoft Corporation with its Microsoft Office suite. Microsoft bundles popular software applications such as Word, Excel, and PowerPoint together and offers them at a discounted price compared to purchasing each application separately.

This strategy not only provides customers with a comprehensive suite of productivity tools but also incentivizes them to opt for the bundled package due to cost savings. By offering Bundle Pricing, Microsoft effectively increases the perceived value of its software suite and stimulates demand for its products, ultimately driving sales and reinforcing its market position in the software industry.

7. Value-Based Pricing [ International Market Pricing Strategies ]

Value-based pricing is a strategic pricing approach where prices are determined based on the perceived value of the product or service in the eyes of the customers. This method focuses on the benefits and value proposition offered by the product, rather than solely considering production costs or competitor pricing.

A quintessential example of Value-Based Pricing is exemplified by Rolex SA, a renowned Swiss luxury watchmaker. Rolex meticulously prices its high-end timepieces based on various factors such as superior craftsmanship, brand reputation, and the esteemed status associated with owning a Rolex watch among affluent consumers. Rather than solely basing prices on production costs or competitor pricing, Rolex places emphasis on the perceived value and prestige associated with its watches. By employing Value-Based Pricing, Rolex effectively aligns its prices with the luxury status and exclusivity of its brand, catering to a discerning clientele willing to pay a premium for the exceptional quality and status symbol associated with Rolex timepieces.

8. Prestige Pricing [ International Market Pricing Strategies ]

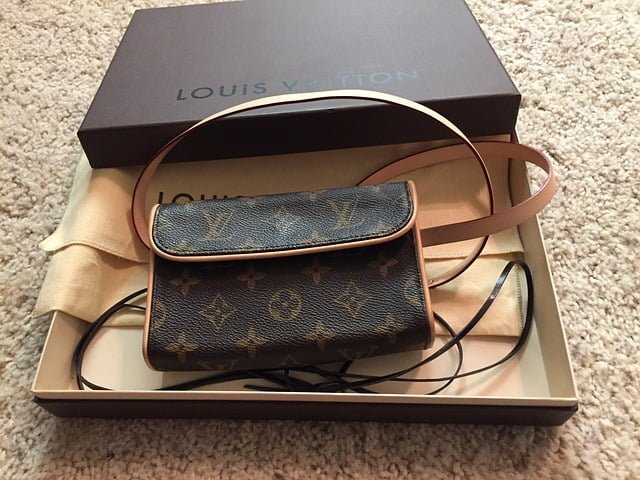

Prestige Pricing is a strategic pricing strategy characterized by setting high prices to cultivate an aura of exclusivity, luxury, and exceptional quality surrounding a product or service. This approach aims to create a perception of value and desirability among consumers, thereby reinforcing the brand’s premium image and positioning.

Luxury bag brands frequently employ Prestige Pricing to uphold their elite status and manage demand fluctuations in the market. For instance, iconic fashion houses like Louis Vuitton may strategically adjust the prices of their coveted handbags during peak seasons or limited edition releases to align with heightened demand and sustain the brand’s premium image.

By implementing Prestige Pricing, luxury brands can maintain their allure and aspirational appeal, appealing to affluent consumers who are willing to pay a premium for the prestige and exclusivity associated with owning luxury goods.

Conclusion

In closing, international pricing strategy plays a pivotal role in the success and competitiveness of companies operating in global markets. By carefully considering factors such as market conditions, competition, consumer preferences, and economic dynamics, businesses can develop effective pricing strategies tailored to each target market. Whether it’s adopting market-based pricing to align with local market realities, employing penetration pricing to gain rapid market share, or leveraging value-based pricing to capitalize on perceived product value, companies must navigate the complexities of international pricing with agility and precision.

Moreover, the diverse array of pricing strategies available—from dynamic pricing to bundle pricing and prestige pricing—offers companies flexibility in adapting to varying market conditions and consumer behaviors worldwide. By implementing the right pricing strategy for each market, businesses can maximize revenue, enhance brand perception, and sustain long-term growth in the global marketplace.

Ultimately, international pricing strategy requires a strategic approach that balances profitability with market competitiveness, while also aligning with the brand’s positioning and customer expectations. With careful planning, analysis, and execution, companies can navigate the complexities of international pricing to drive success and establish a strong presence in markets around the world.

More Stories

- Challenges and Opportunities in Internationalization

- Raohe Street Night Market | Tourist Spot in Taipei, Taiwan

- Shifen Travel Guide | Taiwan | Tourist Spots

- Chung-she Flower Market [ Zhongshe ], Taichung, Taiwan: Travel Guide

- Sakada Coffee Shop: A Sweet Stop in Silay City | A Review

- Pinangat [Laing ] by Quan Delicacies: Embracing Tradition

- Preparing Products for Internationalization | Internet Development

- The Farmhouse | Halo-halo | A Review

- Tomongtong Mangrove Eco-Trail: A Review

Multinational companies must negotiate a difficult field of political, economic, and cultural elements in many locations in order to develop successful international pricing strategies. A solid understanding of customer behavior, laws and regulations, market dynamics, and social and economic factors is necessary. Multinational companies can enhance profit margins while keeping competitiveness by properly preparing and carrying out foreign pricing strategies.

To emphasize the opportunities and challenges associated with international pricing strategies, this comprehensive discussion comprises a variety of theoretical frameworks and case studies in real-world scenarios.

1.Pricing discrimination and market segmentation. Based on variables including customer preferences, income levels, and geographic location, market segmentation theory suggests that multinational corporations may create separate sections within the global market. Multinational Corporations can charge various rates for an identical product in various nations depending on the willingness to pay, due to pricing discrimination.

One of the best examples of a luxury fashion firm using pricing discrimination and market segmentation techniques is Louis Vuitton. Louis Vuitton divides its global market based on multiple factors such as consumer demographics and location, allowing it to customize its pricing strategies and product offers for different customer categories. While competitive pricing ensures accessibility and affordability in new markets, premium prices in wealthy countries are justified by the reputation of the brand, exclusivity, and their work. Louis Vuitton leverages scarcity and exclusivity even more with its carefully considered limited edition price. Louis Vuitton maximizes profits and keeps its competitive advantage in the high-end apparel sector by employing the aforementioned strategies.

2.Dynamic Pricing and Technology Integration. Using customer information, market conditions, and demand variations to change prices in real time is known as dynamic pricing. To effectively execute dynamic pricing strategies, multinational corporations utilize technology and data analytics.

A prime example of dynamic pricing and technology integration is Amazon.com Inc., the massive online retailer well-known for its data-driven pricing optimization strategy and advanced pricing systems.

Throughout its large product catalog, Amazon uses dynamic pricing techniques, changing prices in real-time in response to a variety of variables including consumer behavior, inventory levels, rival prices, and changes in demand. Amazon constantly monitors market trends and uses machine learning techniques to adjust prices for maximum profit while maintaining competitiveness. This is accomplished by merging innovative technology and data analytics.

For example, during major shopping holidays such as Cyber Monday or Black Friday, Amazon deliberately offers discounts on popular products to draw in more consumers while dynamically adjusting pricing to meet rising demand. On the other hand, Amazon may reduce prices in times of low demand or excess stock in order to boost sales and prevent hoarding.

Furthermore, Amazon’s dynamic pricing goes beyond simple product price to include customized pricing plans for certain consumers. Amazon adapts pricing and incentives to enhance consumer happiness and conversion rates by examining browsing history, purchase trends, and demographic data.

Because of its dynamic pricing strategy, which has helped it maintain a competitive advantage and increase revenue, Amazon has become a major player in the e-commerce industry. Amazon continuously improves its pricing plans through combining technology and data-driven insights effectively. This allows Amazon to adjust its tactics to changing market conditions and provide value to its shareholders as well as consumers.

3.Value-Based Pricing Strategies. The perceived worth of goods and services to consumers is the main emphasis of value-based pricing systems. Instead of focusing just on manufacturing costs, Multinational companies price their products according to the value they deliver and the advantages they offer.

Elon Musk’s Tesla, Inc., a cutting-edge electric vehicle manufacturer, is a good example of a company that uses value-based pricing techniques. Offering high-end electric cars with outstanding performance, cutting-edge technology, and sustainability advantages is the foundation of Tesla’s value-based pricing approach. Tesla-based its pricing on the perceived value that its vehicles provide to consumers rather than just production costs. The company takes into account aspects including the impact on the environment, innovation, and brand reputation.

Focusing on product innovation and uniqueness is a crucial component of Tesla’s value-based pricing strategy. Advanced features including long-range batteries, over-the-air software upgrades, improved acceleration, and Autopilot (semi-autonomous driving) are standard on Tesla electric vehicles. These characteristics raise the perceived worth of Tesla automobiles and support their higher pricing point as compared to traditional gasoline-powered vehicles.

Furthermore, Tesla justifies its high price by pointing to its solid brand reputation and dedication to sustainability. Customers that care about the environment and are prepared to pay more for environmentally friendly transportation options find Tesla’s electric cars to be a desirable alternative to traditional automobiles.

Value-based pricing also relates to Tesla’s direct-to-consumer sales strategy and pricing transparency. In doing deal with brokers and regular dealerships, Tesla keeps control over customer service and price, which enables the business to maximize value and sustain larger profit margins.

Tesla’s value-based pricing approach has allowed the business to establish itself as a leader in the electric vehicle industry despite obstacles including manufacturing limitations and supply chain problems. Driving continuous development and competitive advantage in the automobile sector, Tesla’s value-based pricing model is effective as seen by its ability to charge premium prices while offering new goods and sustainability advantages.

4.Cultural Sensitivity and Localization. Consumer behavior and price perceptions are greatly influenced by cultural influences. Multinational companies that want to connect with customers and establish brand trust must modify their pricing strategies to fit local cultures and conventions.

Starbucks Corporation, the well-known chain of coffee shops, is an excellent example of how pricing tactics may be localized and sensitive to cultural differences.

By adjusting its pricing policies to take into account the different preferences and financial circumstances of several international markets, Starbucks is an example of cultural sensitivity. Starbucks has a unique strategy in that its menu prices are variable and depend on local cost of living, currency exchange rates, and consumer purchasing power.

To appeal to consumers who are sensitive to price while preserving its premium brand image, Starbucks provides more economical pricing alternatives in growing regions such as China and India. To fit local budgets without sacrificing quality or perceived value, this could mean offering smaller-sized or bargain-priced beverages.

On the other hand, Starbucks uses premium pricing methods for limited-time or specialty beverages in wealthy regions like the US and parts of Europe, taking advantage of consumers’ desire to spend more for higher-quality coffee experiences.

Additionally, Starbucks demonstrates localization through innovative product development and menu adaption. To accommodate regional tastes and preferences, the firm enhances its menu options with regional flavors, products, and cultural influences. As an illustration of its awareness of regional culinary customs and customer preferences, Starbucks provides matcha-flavored drinks in Japan, chai tea lattes in India, and red bean cakes in China.

Furthermore, Starbucks demonstrates its dedication to cultural sensitivity and localization by its participation in market-specific corporate social responsibility programs and community-focused projects. To improve Starbucks’ brand recognition and resonance with local communities, these activities might involve collaborations with nearby farmers, participation in environmental initiatives, or donations to community development projects.

The brand’s capacity to connect with consumers more deeply while responding to a variety of cultural details and market conditions is demonstrated by Starbucks’ overall effective use of cultural sensitivity and localization in its pricing strategies. Starbucks effectively controls global marketplaces and sustains its standing as the leading coffeehouse company around the globe by harmonizing its pricing methods with regional tastes and values.

5.Competitive Pricing Strategies. Competitive pricing strategies include determining prices by observing how competitors have set their prices and placed themselves in the market. To get a competitive advantage, multinational corporations actively observe their rivals’ pricing tactics and modify their own prices appropriately.

The competition between Samsung Electronics and Apple Inc. in the worldwide smartphone industry serves as a real-world case study that highlights competitive pricing techniques.

The smartphone business is extremely competitive, with Samsung and Apple striving for market dominance and profitability. In order to stay in business and draw clients, both organizations use aggressive pricing techniques.

In summary, developing successful international pricing strategies for multinational corporations necessitates a sophisticated comprehension of market dynamics, legal frameworks, cultural subtleties, and technical developments. Multinational corporations may effectively navigate challenging situations and seize chances to enhance profit margins, sustain competitiveness, and achieve long-term growth in international markets by utilizing theoretical frameworks and real-world case studies.